Moving home is rarely just about a change of scenery. Whether you’re upsizing for a growing

family, downsizing for retirement, or relocating for a dream career, the process of “trading up”

your property in the UK is a complex financial maneuver.

Bank of england base rate currently stands to 3.75% as on January 2026 and the next revision

scheduled for 5th February 2026, home movers finally have the “upper hand” in negotiations.

However, navigating these waters requires more than just a good estate agent—it requires a

robust mortgage strategy.

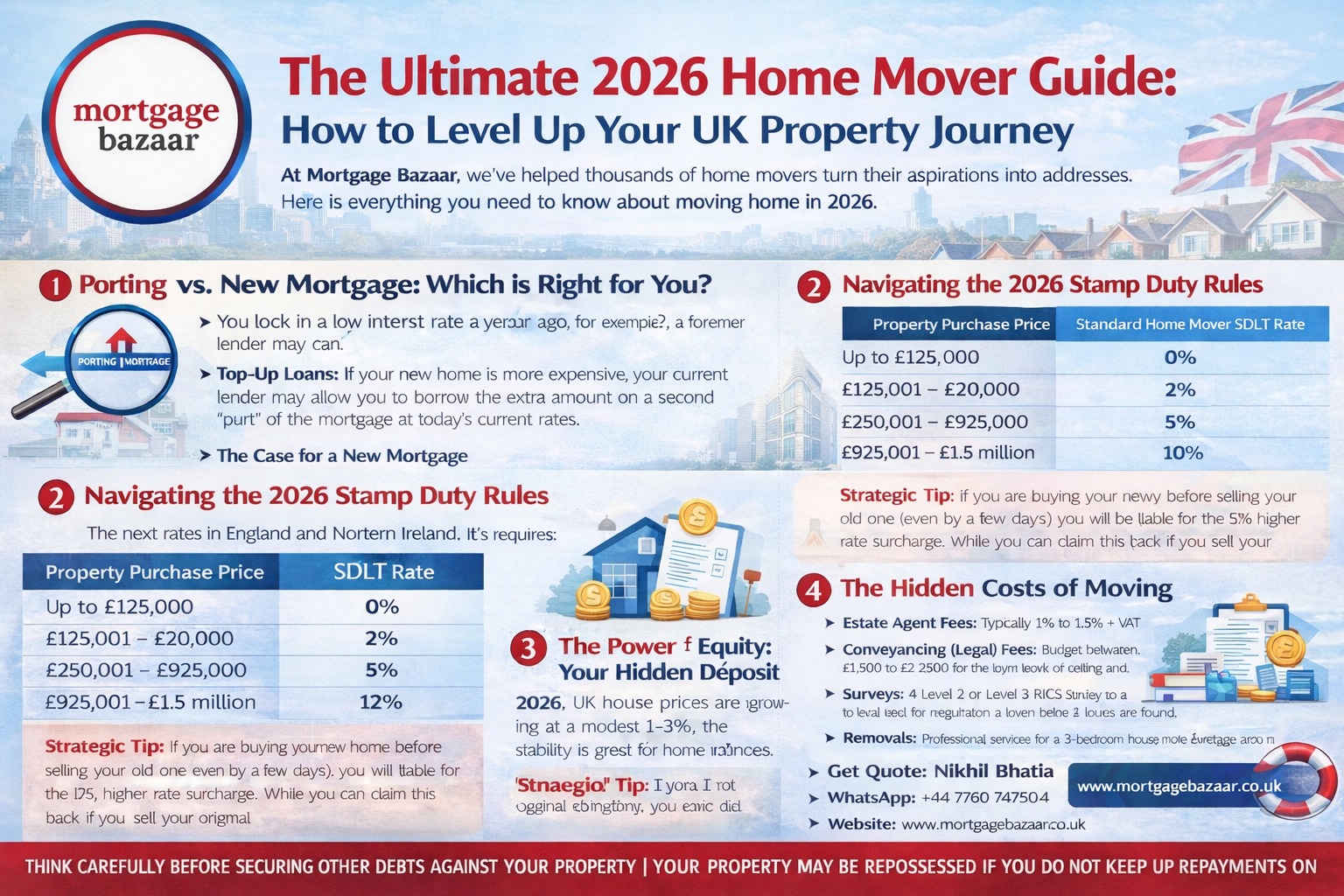

At Mortgage Bazaar, we’ve helped thousands of home movers turn their aspirations into

addresses. Here is everything you need to know about moving home in 2026.

- Porting vs. New Mortgage: Which is Right for You?

One of the most common questions we hear is: “Can I take my current mortgage deal with me?”

This is known as Porting.

The Case for Porting

If you locked in a low interest rate a few years ago (for example, a 5-year fix at 2.5%), you will

likely want to “port” that rate to your new property. This allows you to keep your current monthly

repayments on the existing balance.

- Top-Up Loans: If your new home is more expensive, your current lender may allow you to borrow the extra amount on a second “part” of the mortgage at today’s current rates.

The Case for a New Mortgage

In 2026, many homeowners are finding that their current fixed-rate deal is ending. With the

recent rate cuts, moving to a new lender might actually be cheaper than staying put. At

Mortgage Bazaar, we compare over 200 lenders to see if the cost of an Early Repayment

Charge (ERC) is worth the long-term savings of a more competitive new product.

2 . Navigating the 2026 Stamp Duty Rules

Since the temporary thresholds expired in April 2025, Stamp Duty Land Tax (SDLT) has

returned to its traditional levels. For home movers in England and Northern Ireland, it is

essential to budget for these costs early:

| Property Purchase Price | Standard Home Mover SDLT Rate |

| Up to £125,000 | 0% |

| £125,001 – £250,000 | 2% |

| £250,001 – £925,000 | 5% |

| £925,001 – £1.5 million | 10% |

| Above £1.5 million | 12% |

Strategic Tip: If you are buying your new home before selling your old one (even

by a few days), you will be liable for the 5% higher rate surcharge. While you can

claim this back if you sell your original home within 36 months, it represents a

significant upfront cash requirement.

3. The Power of Equity: Your Hidden Deposit

For a first-time buyer, the “deposit” is a hard-earned pot of cash. For a home mover, the deposit

is usually your Equity—the difference between what your current home is worth and what you

still owe on your mortgage.

In 2026, UK house prices are growing at a modest 1-3%. This stability is great for home movers

because it means the “gap” between your sale price and your purchase price isn’t widening as

aggressively as it did in the post-pandemic years.

4 The Hidden Costs of Moving

While the mortgage is the largest part of the puzzle, the “soft costs” of moving house in 2026

average around £12,000 to £14,000. Don’t forget to budget for:

- Estate Agent Fees: Typically 1% to 1.5% + VAT of your sale price.

- Conveyancing (Legal) Fees: Budget between £1,500 and £2,500 for the joint work of selling and buying.

- Surveys: In a buyer’s market like 2026, a Level 2 or Level 3 RICS survey is a vital tool for negotiating a lower price if issues are found.

- Removals: Professional services for a 3-bedroom house now average around £1,000.

5 Bridging the Gap: What if the Chain Breaks?

The UK “Property Chain” is notoriously fragile. If your buyer pulls out but you don’t want to lose

your dream home, Bridging Loans can be a lifesaver. At Mortgage Bazaar, we offer specialist

advice on bridging finance, allowing you to “act like a cash buyer” and complete your purchase

while you wait for a new buyer for your old home.

6 Why Choose Mortgage Bazaar for Your Move?

Moving home is categorized as one of the top three most stressful life events. Our goal is to

Remove the “financial stress” from that list.

Why we are different:

- Fast Processing: Our average time from application to mortgage offer is just 14 days.

- Independent Advice: We aren’t tied to any one bank. We look at the “big six” lenders and niche building societies to find your perfect fit.

- Property Research: We don’t just find you a loan; we perform desktop research on the property you want to buy, helping you decide if the price is right.

- Expert Protection: We ensure your new home is protected with tailored Life Insurance and Income Protection so your family’s future is never at risk.

Final Thoughts

The 2026 market offers a unique “sweet spot” of falling interest rates and high inventory.

Whether you are looking for more space, a better school catchment area, or a lifestyle change,

the team at Mortgage Bazaar is ready to get you there.

Start Your Journey Today

Ready to find out how much you can borrow for your next move? Contact our award-winning

team for a free, no-obligation consultation.

- Get Quote: Nikhil Bhatia

- WhatsApp: +44 7760747504

- Email: nikhil@mortgagebazaar.co.uk

- Website: www.mortgagebazaar.co.uk

Disclaimer: THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST

YOUR PROPERTY | YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT

KEEP UP REPAYMENTS ON YOUR MORTGAGE.