Buying a home together is an exciting milestone, and joint mortgages are one of the most

popular ways couples combine their finances to afford a property. But things can become

confusing when one partner is a first-time buyer and the other has owned property before.

Many couples ask:

“If my partner is a first-time buyer but I’m not, will this affect our mortgage and stamp

duty?”

The short answer is yes, it does affect your application — especially when it comes to stamp

duty relief and government incentives. However, it doesn’t mean you can’t get a mortgage or

secure a competitive deal.

In this guide, we explain exactly how joint mortgages work when only one partner is a

first-time buyer, what benefits you lose, what options remain, and how to plan smartly.

If you want tailored advice for your situation, speaking to a specialist broker such as Mortgage

Bazaar can help you avoid costly mistakes and secure the best available deal.

Do Both Applicants Need to Be First-Time Buyers?

No, both applicants do not need to be first-time buyers to apply for a joint mortgage. Lenders

are perfectly happy to lend when one partner has owned property before.

However, there is an important catch:

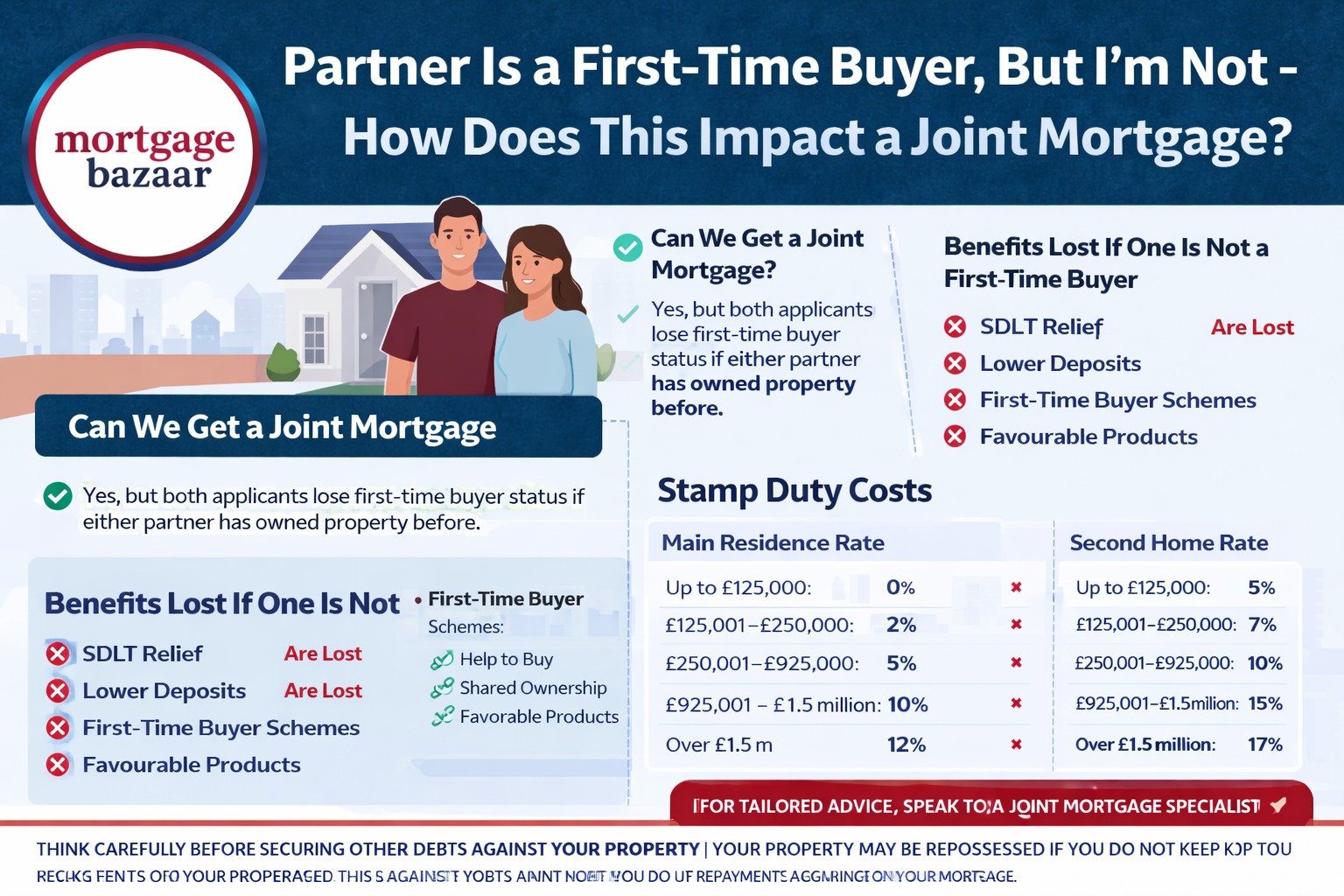

If either partner has previously owned a property, both applicants lose first-time buyer

status.

This affects tax reliefs and government schemes, not your ability to apply for a mortgage.

What First-Time Buyer Benefits Are Lost?

When one partner is not a first-time buyer, the couple loses access to several advantages,

including:

- Stamp Duty Land Tax (SDLT) relief

- Reduced deposit requirements offered to first-time buyers

- Certain government-backed buying schemes

- Preferential mortgage products aimed at first-time buyers

Stamp Duty Relief (From 1 April 2025)

First-time buyers benefit from:

- 0% SDLT on properties up to £300,000

- 5% SDLT on the portion between £300,001 and £500,000

If only one buyer qualifies, these benefits are not available.

Are Couples Still First-Time Buyers If One Has Owned

Property Before?

No. To be officially classed as first-time buyers

- Neither partner must have owned property anywhere in the world

- The property must be residential

- It must be intended as a main residence

If either partner fails this test, the couple is treated as non–first-time buyers for tax and

scheme purposes.

Are There Any Financial Schemes Still Available?

If one partner has previously owned property, most first-time buyer schemes are unavailable.

However, Shared Ownership may still be an option.

Shared Ownership (Limited Use Case)

You may qualify if:

- You cannot afford to buy outright

- Household income is under £80,000 (£90,000 in London)

Important: Shared ownership often limits long-term equity growth and can be restrictive. It’s

Usually not ideal for couples aiming to fully own a property.

Do You Pay Stamp Duty If One Partner Isn’t a First-Time

Buyer?

Yes. Stamp Duty Land Tax applies if either partner has owned property before.

SDLT Rates for Main Residence

Property Value Portion | SDLT Rate |

| Up to £125,000 | 0% |

| £125,001 – £250,000 | 2% |

| £250,001 – £925,000 | 5% |

| £925,001 – £1.5m | 10% |

| Over £1.5m | 12% |

Example: £345,000 Property

- 0% on £125,000 = £0

- 2% on £125,000 = £2,500

- 5% on £95,000 = £4,750

Total SDLT: £7,250

Buying as a Second Home?

If the property is not your main residence, SDLT increases by 5% on every band, making it

significantly more expensive.

| Proportion of Property Value | Stamp Duty Rate |

| Up to £125,000 | 5% |

| The next £125,000 (the portion from £125,001–£250,000) | 7% |

| The next £675,000 (the portion from £250,001–£925,000) | 10% |

| The next £575,000 (the portion from £925,001–£1.5 million) | 15% |

| The remaining amount (the portion over £1.5 million) | 17% |

Can Only the First-Time Buyer Apply for the Mortgage?

Some couples consider applying only in the first-time buyer’s name to claim stamp duty relief.

This approach is risky.

Downsides:

- Lower borrowing power (single income only)

- No legal ownership for the non-applicant

- Complicated legal and tax risks if the relationship changes

- Potential issues if you already own property

In most cases, this strategy causes more problems than savings.

Can a Lifetime ISA Still Be Used?

Yes — the first-time buyer partner can still use their Lifetime ISA, even if the other partner

is not a first-time buyer.

Yes — the first-time buyer partner can still use their Lifetime ISA, even if the other partner

is not a first-time buyer.

Conditions:

- Property value must not exceed £450,000

- The LISA holder must be a first-time buyer

The non-first-time buyer cannot use a LISA for the purchase.

How Does the Mortgage Application Work?

The mortgage process itself remains straightforward.

Lenders will assess:

- Combined income

- Credit histories of both applicants

- Deposit size

- Employment status

- Monthly expenses and debts

Key Factors That Improve Approval Chances:

- Deposit of 10% or more

- Stable employment (PAYE or self-employed)

- Clean or well-managed credit profiles

If credit issues exist, a specialist broker can help access lenders outside high-street banks.

How Much Can You Borrow on a Joint Mortgage?

Most lenders offer 4–5 times your combined annual income.

Example:

- Partner A: £40,000

- Partner B: £45,000

- Combined income: £85,000

Estimated borrowing:

- £340,000 to £425,000

Your final property budget = Mortgage + Deposit

Frequently Asked Questions

Can you be a first-time buyer twice?

No. Once you own a property, you permanently lose first-time buyer status — even if you sell

later

What if I inherited a property?

Inheritance counts as ownership. You lose first-time buyer benefits unless the inherited property

is commercial only.

Can lenders check first-time buyer status?

Yes. Lenders use Land Registry and credit records. Providing false information can lead to

mortgage refusal or legal consequences.

Final Thoughts

If one partner has owned property before, you can still apply for a joint mortgage, but you will

lose first-time buyer tax benefits. The mortgage itself works the same way, and borrowing power

is still based on combined income.

With the right advice and planning, couples in this situation can still secure excellent mortgage

deals. Working with an experienced broker ensures you avoid costly mistakes and choose the

most suitable route forward.

If you want expert guidance tailored to your situation, speaking with a joint mortgage specialist

could make all the difference.

Get Quote: Nikhil Bhatia

- WhatsApp: +44 7760747504

- Email: nikhil@mortgagebazaar.co.uk

- Website: www.mortgagebazaar.co.uk

Disclaimer: THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR

PROPERTY | YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP

REPAYMENTS ON YOUR MORTGAGE.