When you are planning to buy a home, the focus is often on the deposit and the mortgage rate. However, there is one “hidden” cost that can significantly impact your budget: Stamp Duty Land Tax (SDLT).

As we move through 2026, the landscape of property tax in the UK has shifted. The temporary “holiday” thresholds of previous years are now a distant memory, and buyers are navigating a stricter set of rules. At Mortgage Bazaar, we believe that transparency is the key to a stress-free move. In this guide, we break down exactly what you need to pay, how the 2026 thresholds work, and how you can plan your finances accordingly.

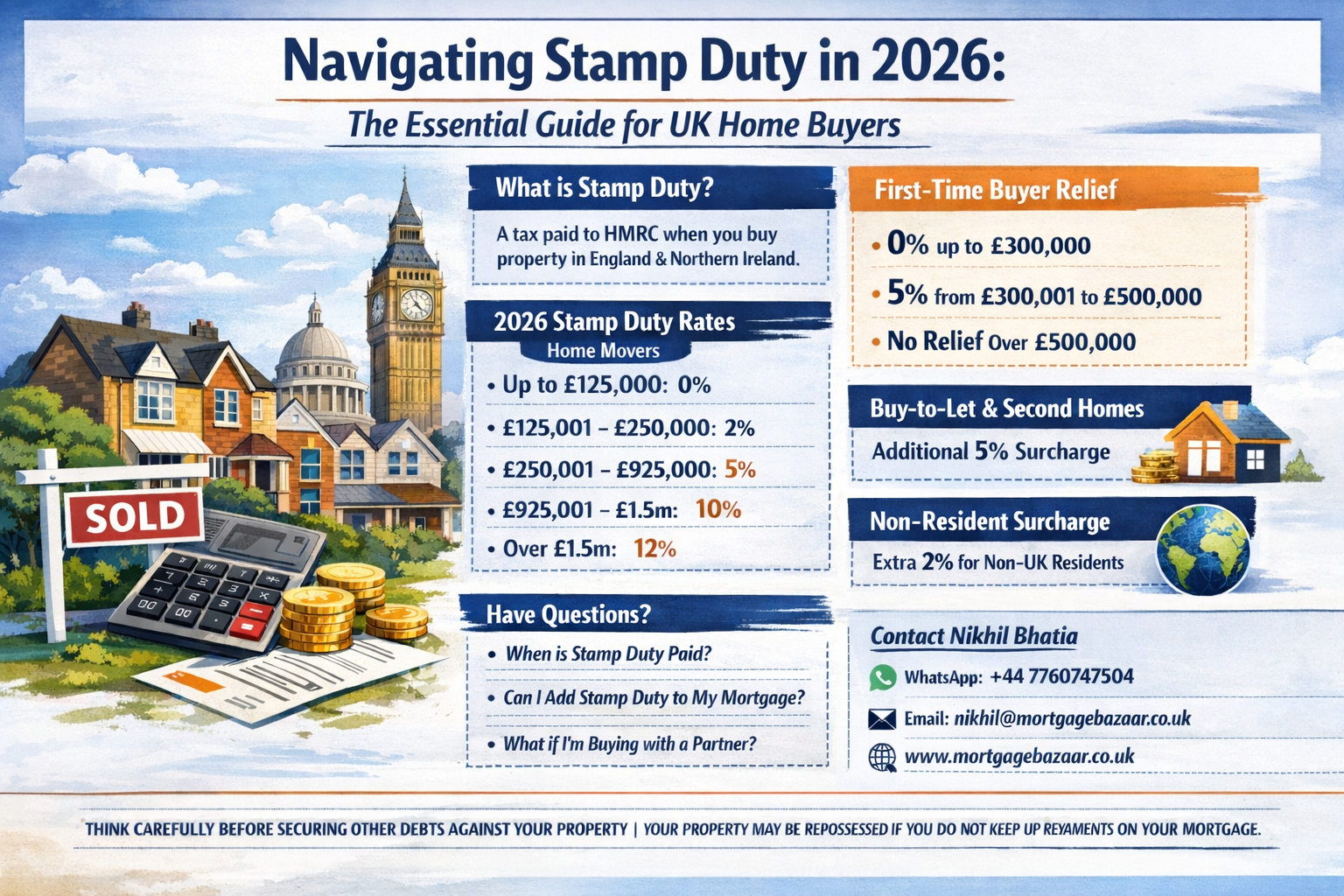

What is Stamp Duty Land Tax (SDLT)?

Stamp Duty is a lump-sum tax paid to HM Revenue and Customs (HMRC) when you buy a property or land over a certain price in England and Northern Ireland. (Note: Scotland uses Land and Buildings Transaction Tax, and Wales uses Land Transaction Tax).

The amount you pay depends on:

- The purchase price of the property.

- Your status (First-time buyer, home mover, or investor).

- The property’s use (Residential vs. Commercial).

1.The 2026 Standard Rates (Home Movers)

If you already own a home and are moving to a new primary residence, you fall under the “Standard Rate” category. Since April 2025, the nil-rate band—the amount you pay zero tax on—has been set at £125,000.

For a typical purchase in 2026, the rates are applied in “slices” as follows:

- Up to £125,000: 0%

- £125,001 to £250,000: 2%

- £250,001 to £925,000: 5%

- £925,001 to £1.5 million: 10%

- Over £1.5 million: 12%

Example: If you buy a house for £350,000, you pay 0% on the first £125k, 2% on the next £125k (£2,500), and 5% on the remaining £100k (£5,000). Your total bill would be £7,500.

2. First-Time Buyer Relief in 2026

At Mortgage Bazaar, we specialize in helping first-time buyers get on the ladder. While the government reduced the relief thresholds in 2025, there is still significant support available in 2026.

- Nil-Rate Band: First-time buyers pay 0% tax on properties up to £300,000.

- Reduced Rate: For properties priced between £300,001 and £500,000, you pay a flat 5% on the portion above £300,000.

- The “Cliff Edge”: If the property costs more than £500,000, you lose the relief entirely and must pay the standard home-mover rates from £125,000 upwards.

This makes the £500,000 mark a critical psychological and financial barrier for buyers in London and the South East. Our advisors often help clients calculate if a slightly lower offer could save them over £10,000 in tax.

3.Buy-to-Let and Second Home Surcharge

The 2026 market remains a challenge for investors. Following the October 2024 Budget, the surcharge for additional properties was increased to 5% on top of the standard rates.

If you are purchasing a rental property or a holiday home, your starting rate is 5% even on the first £125,000. This is designed to prioritize owner-occupiers over investors. At Mortgage Bazaar, we work with professional landlords to ensure their unified finance agreements are structured to account for these upfront costs.

4.Non-UK Resident Surcharge

The UK remains a global hub for talent, and many of our clients are here on Skilled Worker Visas. If you have not lived in the UK for at least 183 days in the 12 months before your purchase, you may be subject to an additional 2% non-resident surcharge.

When combined with the investor surcharge, a non-resident buying a rental property could face a starting tax rate of 7%. It is vital to speak with a broker at Mortgage Bazaar early to determine your residency status for tax purposes.

5. Common Questions About Stamp Duty

When do I have to pay?

You must file an SDLT return and pay the tax within 14 days of completion. Usually, your solicitor will handle this for you, but the legal responsibility lies with you, the buyer

Can I add Stamp Duty to my mortgage?

Technically, no. Lenders rarely allow you to borrow more than the property’s value to cover tax. You should view Stamp Duty as a “day one” cash requirement alongside your deposit and legal fees.

What if I’m buying with a partner?

To claim First-Time Buyer relief, both partners must be first-time buyers. If one of you has owned property anywhere in the world (including inherited property), you will likely have to pay the standard rates.

6 Strategies to Manage Your Stamp Duty Bill

Given that Stamp Duty can often cost as much as a 5% deposit, how can you manage it?

- Negotiate on Price: If a property is priced at £505,000, negotiating it down to £500,000 could save a first-time buyer over £11,000 in tax.

- Factoring it into Affordability: When we calculate your “Agreement in Principle,” we don’t just look at the monthly payments. We look at your total cash-on-hand to ensure you aren’t caught short on completion day.

- Transferring Property: If you are moving but keeping your current home to rent out, you will pay the higher 5% surcharge. However, if you sell your original home within 36 months, you can often claim a refund of that surcharge.

Why Choose Mortgage Bazaar?

At Mortgage Bazaar, we do more than just find you a loan. We act as your financial architects. Whether you are navigating the complexities of Skilled Worker Visa Mortgages or expanding a professional property portfolio, our goal is to ensure you understand every penny of your investment.

With access to 200+ lenders and a deep understanding of the 2026 tax codes, we help you lock in the best rates while planning for the “extras” like Stamp Duty and Protection.

Ready to calculate your costs?

Don’t let tax catch you by surprise. Contact our expert team for a comprehensive breakdown of your buying costs today.

- Get Quote: Nikhil Bhatia

- WhatsApp: +44 7760747504

- Email: nikhil@mortgagebazaar.co.uk

- Website: www.mortgagebazaar.co.uk

Disclaimer: THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR PROPERTY | YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.